“The value of a company is more than its stock price”

Paul Druckman is Chairman of the World Benchmarking Alliance, he is also active in the Workiva ESG Advisory Council among other things. We had the chance to speak with him during Workiva Amplify EMEA in Amsterdam – Amplify is a global conference organised by Workiva that unites thousands of passionate accounting, finance, ESG, audit and risk professionals. As the world’s leading cloud platform for assured integrated reporting, Workiva brings together financial reporting, Governance, Risk, and Compliance (GRC), & Environmental, Social and Governance (ESG) data together in a controlled, secure, audit-ready platform. This interview with Workiva advisor Paul Druckman discusses why reporting is not just a duty, but a chance to change behaviour.

Paul, Your background is in the software industry. How did you find your way in a more philanthropic area?

Paul Druckman is Chairman of the Worldwide Benchmarking Alliance. He is an auditor and has founded a software company. He is active, among other things, as Chair of the World Benchmarking Alliance, on the Workiva ESG Advisory Council and the UK Impact Investing Institute, as a Trustee of Shift and Accounting for Sustainability, and as an Honorary Professor at Durham Business School.

Past highlights have included serving as President of the Institute of Chartered Accountants in England & Wales (ICAEW), Chair of the Executive Committee of The Prince’s Accounting for Sustainability Project (A4S), and as Board Member and Chair of UK Accounting Standards by the UK regulatory authority (FRC).Paul has been awarded the International Federation of Accountants Global Achievement Award, the International Accounting Bulletin Personality of the Year, the Chartered Governance Institute Outstanding Achievement Award and Honorary Membership of the ACCA.

To be truthful, my wife is a university professor of sustainability, and we have always been interested in sustainability. And when I sold my software business, more than 20 years ago, I started promoting sustainability to the accounting world and then more broadly.

What are your objectives?

It is not all about reporting. Reporting is only a vehicle towards my aim to show that reporting influences behaviour. Sustainability in the capital markets lacks broader accountability. Corporations must understand that they have a role to play here and that there are consequences to what they do and what they impact.

Data and information changes thinking and understanding. It is not about esoteric ideas; it is real stuff: for example, just think about measuring scope 1. The problem, why some companies are holding back in sustainability and integrated reporting, is not that they are not willing, but many do not have the knowledge and the experience. That lack of expertise is key and they must catch up very quickly.

What about the Impact Investment Institute?

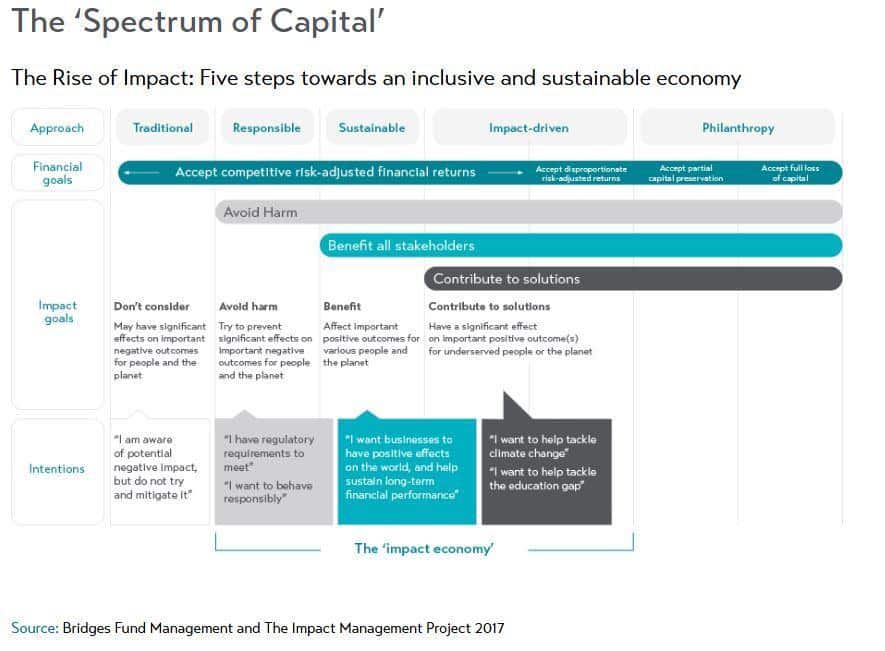

I was involved in its creation, it was set up initially to promote positive, measurable social and environmental impact alongside a financial return. If I can compare it to the Gartner hype cycle, I am convinced that impact investing is over the Trough of Disillusionment and moving up the Slope of Enlightenment.

Some people think that investment in the military might be sustainable. What do you think?

Difficult. Let me give you a different example: If success depends on growth of Gross Domestic Product (GDP) there are unforeseen consequences. If there is a significant car accident, it is good for a country’s GDP: You need a garage to repair your car, a hospital to take care of the injured and so on. But is an accident good? Should you have more accidents? Of course not!

Can you measure end-to-end, if it is a sustainable investment?

My answer is yes but! For example, if the focus is on human rights, the assessment does not yet extend to the complete supply chain. You cannot go into every detail, but it is possible to gain an overview of the situation.

If you could formulate a wish, what would that be?

Corporate accountability being a process that helps companies to transform so that they play their part to help build a fairer and more sustainable world.

Paul, thank you very much for the interview.